In the weekend edition of the Kerrville Daily Times, published on March 30, city council candidate for Place 2, Mario Garcia, published an alarmist advertisement that characterized the City of Kerrville as a debt-plagued government body that is driving the community over a financial cliff. These claims are misleading, at best. While we are used to half-truths from national political figures, we hope that our local politicians can stay “above the fray” and give the citizens honest and complete information. Unfortunately that is not the case with this ad.

According to a recent (unscientific) poll conducted on the Kerrville United Facebook page, approximately 2/3 of our readers HAVE seen city council political ads in one of the local newspapers, so we feel it is important to fact-check these ads, provide context, and give additional resources to voters to peruse on their own.

The whole story of the city’s finances is very complex and cannot be reduced to bumper sticker slogans and simple charts. But if you read no further, you should know that Kerrville continues to receive an “AA” rating from independent ratings agency Standard & Poors (you know, S&P, as in the S&P 500). The S&P evaluates cities across the country and rates their ability to pay their current debt, as well as their “credit rating” to take on new debt. It’s kind of like Kerrville’s credit score. According to Standard & Poors…

An obligor rated ‘AA’ has very strong capacity to meet its financial commitments.

S&P Website

Contrary to what Mr. Garica concludes in his advertisement, S&P considers Kerrville’s financial situation to be strong and healthy when considering all of the factors that they examine, including creditworthiness and capacity to meet financial commitments.

We examined the city’s finances in detail in our 2017 white paper entitled, “Financial Review of the City of Kerrville.” While the specific numbers have changed a little, the overall concepts have not, and that paper is a great primer to read before we go further.

The advertisement in the Kerrville Daily Times, which was paid for by Mario Garcia’s political campaign, also endorses George Baroody as a candidate for Place 1. The full ad is printed below. Click the image to see it full-size.

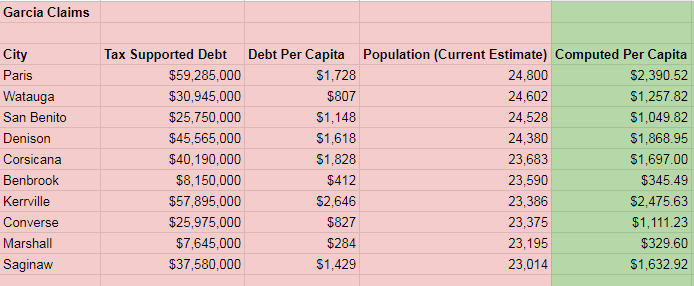

Bad Math

At the top, Mr. Garcia presents a table titled, “How Kerrville Compares.” In this table, he compares Kerrville to nine other cities of similar populations and gives their “Tax Supported Outstanding Debt,” “Tax Supported Debt Outstanding Per Capita,” and “Population.” However, the numbers don’t add up! The per capita debt should be found by taking the total debt and dividing it by the population. But when you do that, you get different numbers than what Mr. Garcia has presented. See the figure below. In red are Mr. Garcia’s numbers, and in green are the numbers as calculated using his figures for total debt and population.

FOOTNOTE: It appears that Mr. Garcia took these numbers directly from the State Comptroller website without checking to see if the math was correct. For an advertisement that appears to question the competence of government, he seems to put a great deal of faith in the numbers provided to him for this message.

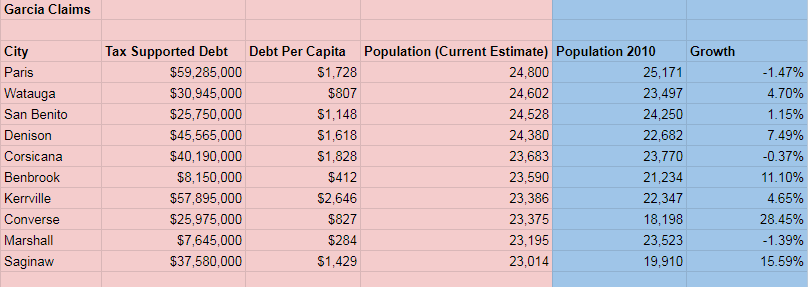

Even if we put aside the fact that the numbers don’t compute, we can also immediately see that these nine other cities look nothing like Kerrville. For one, many of the cities have experienced much less growth than Kerrville has experienced since 2010. In fact, several of the cities including Paris, Corsicana, and Marshall have seen NEGATIVE population grown since 2010. We would expect that cities that are shrinking or growing more slowly than Kerrville would be incurring less debt to finance expansions of utilities, services, or public works. But cities that are growing, such as Kerrville, which has experienced 4.6% population growth since 2010, should be financing expansions of municipal services to keep pace with that growth — one element of responsible growth!

Other Differences Between the 10 Cities on the List

When placing these nine Texas cities on a map, one will immediately notice that none of the cities are anywhere near Kerrville geographically, and further, most of the other cities are very close in proximity to a major urban center such as Dallas, Fort Worth, San Antonio, and Harlingen. Meanwhile, Kerrville is geographically isolated out here in the Texas hill country, with no major urban centers to rely upon for major infrastructure such as water, sewer, and roads.

We are on our own to provide all of the services we need locally, which includes expensive infrastructure costs for things like a sewer plant, water plant, electrical service, roads, bridges, and more. Our unique hill country topography and relative remote location makes all of these items more expensive than they would be in flatter urban areas. Thus it is hard to compare Kerrville’s finances and operations to these other cities.

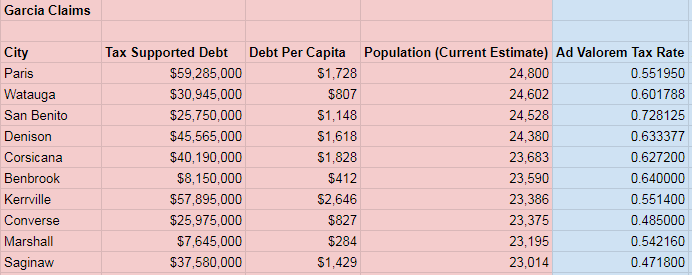

Comparing Tax Rates

One fact that Mr. Garcia left off of his ad is Kerrville’s total tax rate compared to these other nine cities. Interestingly, Kerrville’s tax rate is LOWER than six of the other cities on this list. It seems at odds with Mr. Garcia’s conclusions to point out that Kerrville, with the second-highest tax-supported debt total on the list, also has one of the lowest tax rates on the list. Kerrville has not raised the property tax rate for 10 straight years. In fact, in 2010, City Council established a policy that no new tax-supported debt would be issued that would require a tax increase. That policy remains in place to this day.

(Sources: City of Kerrville 2019 Annual Budget; City of Kerrville Comprehensive Annual Financial Report 2018)

Types of Debt and Payments

How is this possible? The reason that Kerrville is able to pay off the debt we have without raising taxes is because the majority of the “tax-supported debt” is not actually paid for with property tax revenue. For example, according to the City of Kerrville’s 2018 debt disclosure document, of the approximately $60 million in outstanding debt, more than $30 million is related to water, sewer, and other infrastructure. Those debts are typically paid off using water and sewer revenues (your water bill).

Another large portion of the debt is related to the River Trail and Sports Complex, which are bonds that are paid off using 4B sales tax revenues from the EIC — NOT from property taxes. The EIC is paying about $1.1 million per year for the River Trail and Sports complex (about 44% of the total annual debt service for the general fund). However, to get a good rate on that debt, the notes are SECURED using ad valorem property taxes. So even though we don’t use ad valorem taxes to pay off these notes, we do use the taxes we collect as COLLATERAL to secure a better deal.

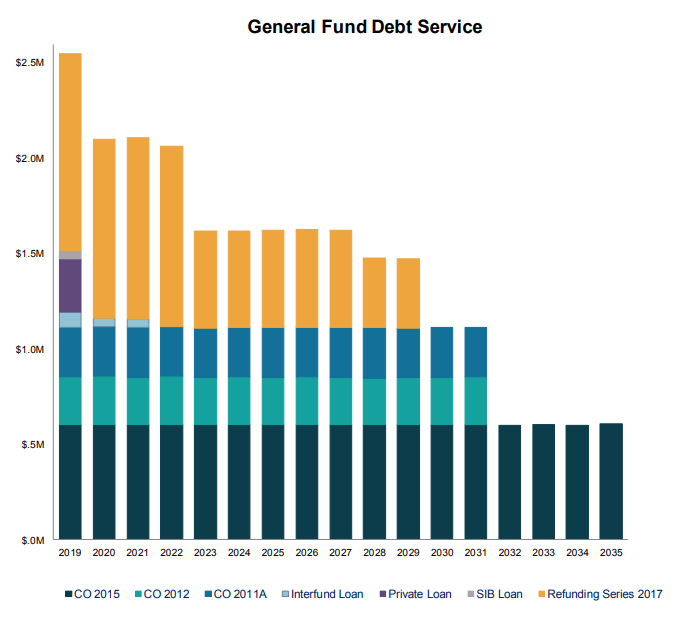

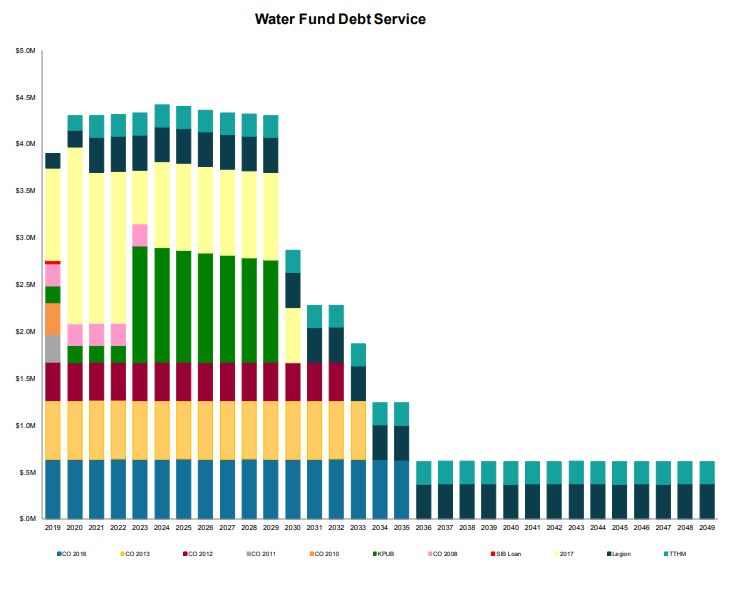

As you can see in the graphs below, the city’s debt service is around $2.5 million annually for the general fund debt and about $4 million per year for the water fund debt. As mentioned above, the EIC pays about $1.1 million per year, and the ad valorem taxes only pay about $1.4 million per year right now. But by 2020, you see our debt service start to fall as some of the loans/bonds are paid off. At this rate, if we don’t incur any new debt, our payments on the general fund debt would be down to about $500,000 by 2032.

The Water and Sewer Fund debt is paid for with revenues from your utility bills, but it is also secured by ad valorem taxes so that we can get a good rate on the notes. This is another misleading factor from Garcia’s ad, because this is a large portion of our debt, yet we’re not using our property taxes to pay it off.

New Debt?

Garcia’s ad also mentions the city’s consideration of taking on new debt in the form of a General Obligation (GO) bond in November 2019. The city is considering a bond issue, according to statements made in the FY2019 budget (page 202). The budget document states:

The City anticipates holding a bond election in November 2019. The City will propose issuing new debt without raising taxes in order to fund General Fund projects, such as a Public Safety Complex

Debt Changes, Page 202, City of Kerrville Budget FY 2019

What’s important to note here is the word “election.” The city is contemplating putting this matter before the voters. Also, importantly, adding new debt to finance a Public Safety Complex for enhanced fire and police protection would be achieved WITHOUT raising taxes.

Financial Summary and Takeaways

City finances is a very complicated subject. It takes a lot of work to understand the intricacies. But luckily, as a voter and a taxpayer, you’re not expected to be totally fluent in all aspects of city financial statements. What you should know, though, is that Garcia’s numbers don’t add up mathematically, and they’re not a fair representation of the city’s complete financial picture.

Here are just a few key takeaways…

- City Council has a policy that it WILL NOT increase taxes to pay for new debt. This policy has been in place since 2010.

- Standard & Poor’s ranks Kerrville with an “AA” rating and has stated in their review that Kerrville demonstrates “very strong management with strong financial policies and practices”

- The city also has a policy that Water and Sewer Fund debt CANNOT exceed 35% of the fund’s annual revenue. Right now we’re at roughly 31%, so we’re under that conservative benchmark policy.

- Much of the city’s debt is not actually paid for out of ad valorem (property) taxes, but most of it is SECURED using that tax base so that we can achieve a good interest rate. Right now we pay interest rates as low as 2.25% (Water Development Board subsidized bond) which is VERY LOW.

- Since a large portion of our debt is NOT paid for by property taxes, the claim that every “man, woman, and child” is on the hook for nearly $3,000 of debt is not valid or helpful.

- Kerrville’s total debt has increased since 2008, as Garcia claims, and most of that increase is to pay for repair, maintenance, and construction of infrastructure projects like water and sewer facilities. Thanks to the utility bills you pay every month, the city is able to finance and pay off these infrastructure improvements that will help Kerrville continue to grow responsibly AND take care of our current needs.

- The City of Kerrville passes a balanced budget every single year. For the city’s largest operating funds, expenditures do not exceed revenues.

- Comparing Texas’s debt to New York’s debt does not seem relevant or important in the least. Invoking “New York values” seems to be purely political theater in this context and does not provide useful information.

- Any new debt issuance for a public safety complex would be put to a vote, according to the city’s budget documents published in 2018.

- Garcia’s ad is misleading and does not represent the truth about the city’s complete financial picture.

Thanks for reading this very nuanced and complicated article on a very nuanced and complicated subject! Please contact us with any questions you may have. Also, check out this video that we created in 2017 that explains the city’s finances in greater detail.

Citations and Sources:

- City of Kerrville Comprehensive Annual Financial Report 2018

- City of Kerrville Budget FY 2019

- Debt Obligations by Issuance, City of Kerrville Finance Department, 2018

- Standard & Poor’s Global Ratings Guidance

- State Comptroller’s “Debt at a Glance” Section

- Tax rate information found in each municipality’s document titled: Notice of 2018 Tax Year Proposed Property Tax Rate (various city websites across the state)

- Kerrville United White Paper on city finances (additional citations found within)