April 15 is notorious as the deadline for filing federal tax returns, but it is also the date that the local appraisal district started mailing out notices of 2019 values. Kerr Central Appraisal District is an independent government entity that sets appraised values for all real property within its jurisdiction — the entirety of Kerr County. Taxing entities collect taxes based on those values, including Kerrville ISD, Kerr County, City of Kerrville, UGRA, and Headwaters, as well as others, if you live within the city limits of Kerrville.

Important things to remember…

- Kerr Central Appraisal District (KCAD) is independent, and is not controlled by any of the taxing entities. In other words, Kerr County and the City of Kerrville do not control the values that KCAD sets.

- KCAD is governed by a board that hires a chief appraiser, but the board does not set the values and does not interfere with the day-to-day operations of the staff.

- KCAD’s Appraisal Review Board (ARB) is a separate body and serves as the “judicial review” entity for all disputes about values. However, this board also has no control over the initial valuations or the day-to-day operations of KCAD staff.

- The chief appraiser is Sharon Constantinides, and she started in this position in March 2017, having previously served as the deputy appraiser. This position is hired by the KCAD board — not an elected position. She oversees all day-to-day operations and valuations.

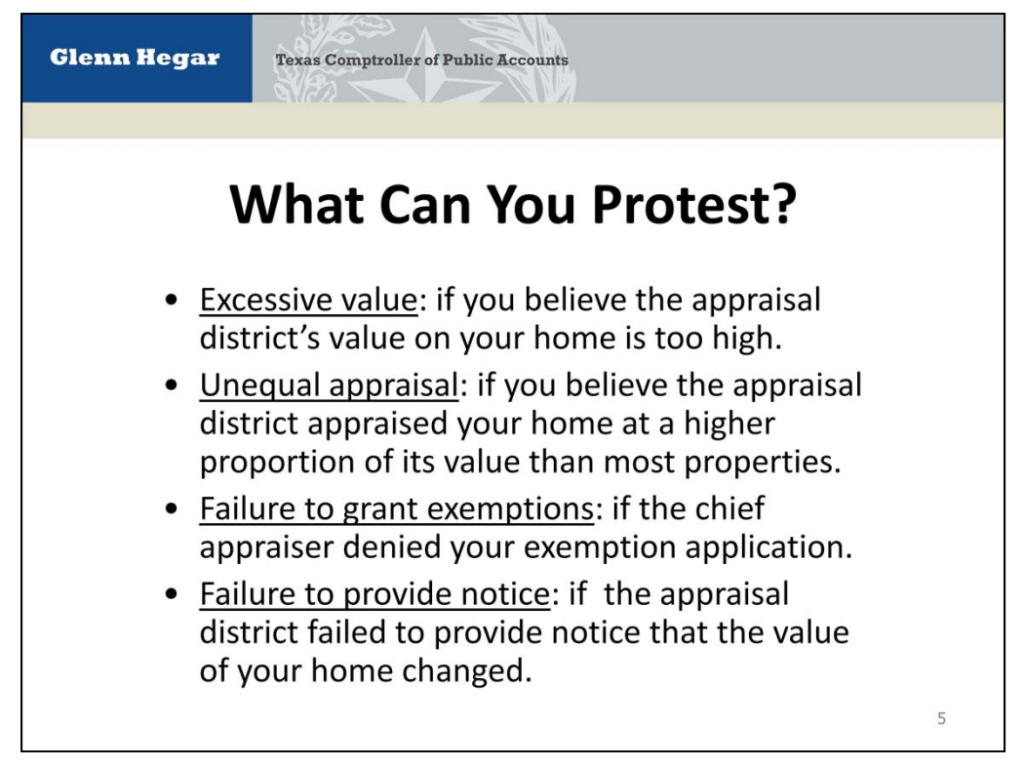

- You DO have the right to protest any increase in your property valuation. The process to do so begins a Notice of Protest, available on the KCAD Forms page. You may wish to speak with an attorney or other professional before you begin this endeavor.

What do we know?

So far, we only know what we’ve been told from property owners who have received their 2019 notice of appraisals… Many of the valuations have increased dramatically. Unfortunately KCAD is closed today for the Good Friday holiday, so there is very little new information we can provide at this time. We have made calls and have reached out to various persons with knowledge of these matters. As soon as we have hard facts to share, we will post them.

Does this have to do with TIRZ or the City?

Many social media commentors have speculated that the increases in valuation are somehow tied to the city’s TIRZ program. Short answer… No, it has nothing to do with TIRZ. The City of Kerrville and the City Council have no control over the valuations that are set by KCAD. Even though one city council member also serves on the KCAD Board (Mrs. Judy Eychner, Place 3), as mentioned above, the KCAD Board has no influence over the valuations that are computed and set by the KCAD staff and appraisers.

Will the city potentially collect more revenue if property valuations increase? Yes. And that’s how things are supposed to work. The city sets the tax RATE, which is used to compute how much property tax you pay to the city. Other entities set their own tax rates. But the city has no control over the valuations. As property values rise within a city and more development takes place, it becomes more expensive for the city to provide basic services such as water, sewer, fire protection, police protection, permitting, and code enforcement. Therefore, increases in property values provide an increase in city revenue to help offset those costs and allow our city to continue to serve its residents and taxpayers.

The TIRZ is simply an imaginary line that “fences in” a portion of the city and designates all tax increases within that zone to be used for specific purposes. The TIRZ does not raise taxes, it simply dictates where those revenues are spent, and how they’re allocated. From what we’ve gathered so far, it doesn’t appear that the increased valuations are in any way tied to one specific part of the city.

Something else to keep in mind is that the City only collects a small portion of the total property taxes you pay every year. For 2018-2019, if you live in Kerrville, your total tax rate would be $2.27663 per $100 of assessed value. The city only collects $0.5514 of that total — about 24%. The rest goes to Kerr County, a roads fund, Kerrville ISD, UGRA, and Headwaters. See the city’s chart for more detailed information.

HB2 and SB2 — State of Texas

One thing that’s important to keep in mind as we begin our investigation is that the State Legislature is considering HB2 and SB2, two bills that could affect the appraisals in future years. In March, the Senate voted in favor of a bill that would require an election if a local government entity wanted to increase some of its tax collections by 5% or more. Not only would this affect government entities and their nominal tax rates, but that threshold is also computed using the increases in valuations from year to year. From the Texas Tribune…

Because Texas has no state income tax, it relies heavily on sales and property taxes. The state and local entities split sales taxes. But only local entities receive property taxes. It’s unconstitutional for the state to levy property taxes, and state lawmakers don’t have the power to set those rates.

The current and proposed thresholds that could allow a rollback election aren’t based entirely on the actual tax rate, which is the amount per $100 of property value that a government entity levies against landowners. Instead, the formulas focus on how much total tax revenue a local entity receives from properties from one year to the next. So a city or county could hit the threshold for an election without changing its tax rate if there was a significant increase in local property values.

Currently, an 8 percent property tax increase or higher allows voters in a city or county to gather signatures to call for an election on the new rate. Bettencourt’s bill would lower that threshold to 5 percent and would require an automatic election.

https://www.texastribune.org/2017/03/21/senate-gives-preliminary-ok-controversial-property-tax-bill/

Takeaway

For now, we must wait for more information. It’s important for everyone to be patient as the situation evolves and as more information becomes available. Know that you have the right to protest your increase in value, and you have plenty of time to do so. For now, hold tight, and let the journalists and influencers do their work to bring you the full story.