Tuesday night’s City Council meeting was the first meeting that included in-person visitors since the pandemic precautions began in March. Held at the Cailloux Theater to allow for in-person attendance and social distancing, the meeting included the second and final readings of ordinances adopting the official budget and ad valorem tax rate for fiscal year 2021. Some of the budget highlights include:

Budget Highlights

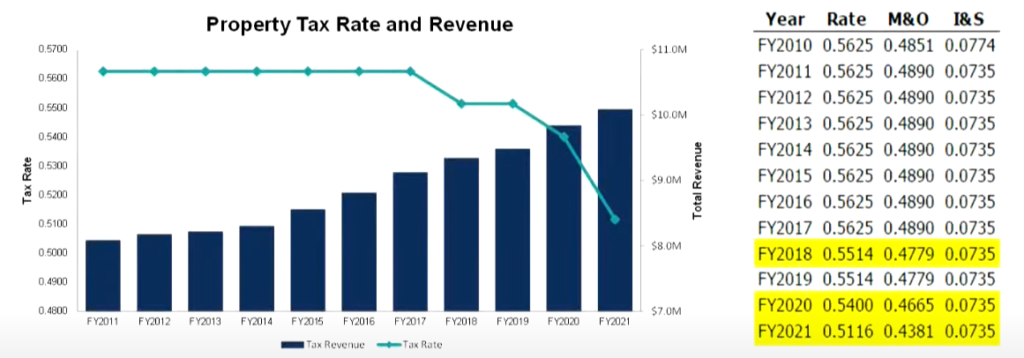

- Property tax rate lowered from $0.54 to $0.5116 per $100 of assessed value. This equates to a 5.25% reduction in the tax rate.

- This lowered tax rate represents the “no new revenue” tax rate, meaning that the amount of revenues raised by the city via ad valorem taxes will be the same as it was the previous year.

- This is the third time in four years that the tax rate has been lowered, and the 11th consecutive year of the same or lower tax rates.

- No proposed changes to water or sewer rates.

- Investment in several drainage projects to fix high-priority issues.

- Investment in capital projects to fix some of the city’s worst streets.

- Additional funding for annual street repairs — increased from $1.75 million to $1.8 million.

- Approximately $2 million in budget cuts across all departments.

- Sales tax and hotel occupancy tax projections were decreased in response to the changing economic realities following the COVID-19 pandemic.

- City staff will receive no merit or cost of living raises, and public safety “step” increases are withheld.

- Employee count has been reduced by delaying new hires and eliminating two vacant positions.

- The policy of maintaining a general fund reserve balance of approximately 25% of expenditures remains — in fact, the new budget projects a reserve balance closer to 30% at the end of next fiscal year.

The budget process began on March 10 with the first of several budget workshops — public meetings of city council that discussed the budget in great detail. This process culminated in the first reading and public hearings on August 25, and the final public hearings and second reading on September 8, when the budget was officially adopted. The new fiscal year begins on October 1.

Tax Rate Reduced

The biggest news in this budget is the property tax rate. For the third time in four years, City Council voted to reduce the ad valorem tax rate. Earlier this year (as well as last year), many property owners in Kerr County were surprised by quickly rising property valuations as determined by Kerr Central Appraisal District, the independent government agency in charge of determining property values. Responding to these rapid increases and taxpayer concerns, this year’s city budget reduces the tax rate by about five percent, to the state-defined “no new revenue” rate of $0.5116 per $100 of valuation.

This means if you own a house that is valued at $200,000, at last year’s rate, you would be required to pay approximately $1,080 in taxes to the city (before any exemptions, freezes, or other reductions). With the reduced rate, your tax liability to the city this year would be approximately $1,023 — a savings of just under $60, or about 5%.

Two things to keep in mind… First, the city collects only about 20% of the total ad valorem taxes that you pay. Other taxing entities, such as KISD, Kerr County, UGRA, Headwaters, and special districts collect the remaining 80% of your tax liability. Second, it’s important to remember that KCAD sets the value on your home, and the city, county, and other government entities do not have any influence over property valuations. And because the average valuation increased from last year to this year, the average property owner will likely pay the city roughly the same amount that was paid last year.

The charts below show the tax rate compared to total revenue. The teal line shows the tax rate reductions over three of the past few years. The numerical chart at the right show the total tax rate and the two tax rate components — maintenance/operations and interest/sinking.

Takeaways

- Significant economic changes resulting from COVID-19 have forced many local government entities to raise taxes to make up for budget shortfalls. Kerrville actually lowered its tax rate by over 5%.

- Over the past decade plus, Kerrville has maintained or lowered its tax rate every year, and has reduced the tax rate for three of the past four years.

- Rising property valuations across Kerr County have been a cause of concern for many taxpayers.

- Despite a reduced budget, funding for street repairs was increased, and other capital projects will stay on track.

- Reserve funds will stay intact, and the reserve balance will actually increase (as a percentage of expenditures).

References

- Video of Kerrville City Council Meeting on August 25

- August 25 Agenda Packet

- Video of Kerrville City Council Meeting on September 8

- September 8 Agenda Packet

- Proposed Budget Book FY21

- Kerrville City Council web page

- “Governments eye new taxes on cigarettes, homes and tech giants to pay for big budget shortfalls related to the coronavirus.” Washington Post. June 26, 2020.