Earlier this month, the City of Kerrville along with its State of Texas partners announced the details of “Project Skymaster,” which is a landmark economic development achievement for Kerrville and surrounding communities. The code name “Skymaster” was used on public-facing documents and agendas for more than a year as community leaders worked behind the scenes to negotiate and secure an agreement with Killdeer Mountain Manufacturing (KMM) that will supply 400 jobs to Kerrville over the next 25 years. The city’s joint press conference is available below, and additional information and details are presented below the fold.

DISCLOSURE: Your author, Aaron Yates, is a member of Kerrville’s Economic Improvement Corporation (EIC) which is one of the funding mechanisms for this economic development agreement. Aaron’s private business, KerrvillePhoto.com, provided videography services to broadcast the press conference embedded above.

Headlines

Summarizing the top-level headlines of this agreement:

- KMM is a North Dakota-based manufacturer of electronic components for military and aerospace industries, employing several hundred people in North Dakota. Their existing customers include the US military, Boeing, Raytheon, and Lockheed Martin.

- According to the agreement, KMM will expand operations to Kerrville and will fill 400 jobs over the next 25 years with annual wages of at least $42,000.

- 200 of those jobs will be created within 10 years, totaling approximately $52.6 million in company payroll during that first 10 year period.

- KMM will invest approximately $10 million in capital to the new facility.

- KMM has secured approximately $1.76 million in state funds and incentives for this expansion to Texas. Those incentives include $900,000 from the Texas Enterprise Fund, $360,000 from the Texas Workforce Commission’s Skills Development Fund, and a $3,000 veteran-created job bonus.

- Kerrville’s EIC will provide approximately $2 million in incentives, including the purchase of a $1.8 million building and a forgivable loan of $250,000 for renovations to the building. These incentives are funded by 4B sales tax dollars which, by law, must be spent on qualified economic development projects.

- The City of Kerrville will contribute approximately $160,000 of incentives in the form of utility extensions and waived fees for the project.

- The City will NOT offer property tax or sales tax abatement.

- At this time, no other government entity is offering incentives.

- Other taxing entities and the City of Kerrville will benefit from increased tax revenues such as ad valorem taxes and private business property taxes.

The City’s contributions and incentives are explained by City Manager Mark McDaniel at minute 33 of the video below.

Community Benefit

According to the agreement (which is still being drafted for consideration by City Council), KMM will add at least 400 jobs in Kerrville over the next 25 years. All of the financial incentives offered by the City/EIC are tied to that “specific performance” — job creation. And at least 60% of those jobs must include Kerr County residents. The annual wages for these jobs will be at least $42,000. (For comparison, a first-year teacher in local districts starts at approximately this same wage.)

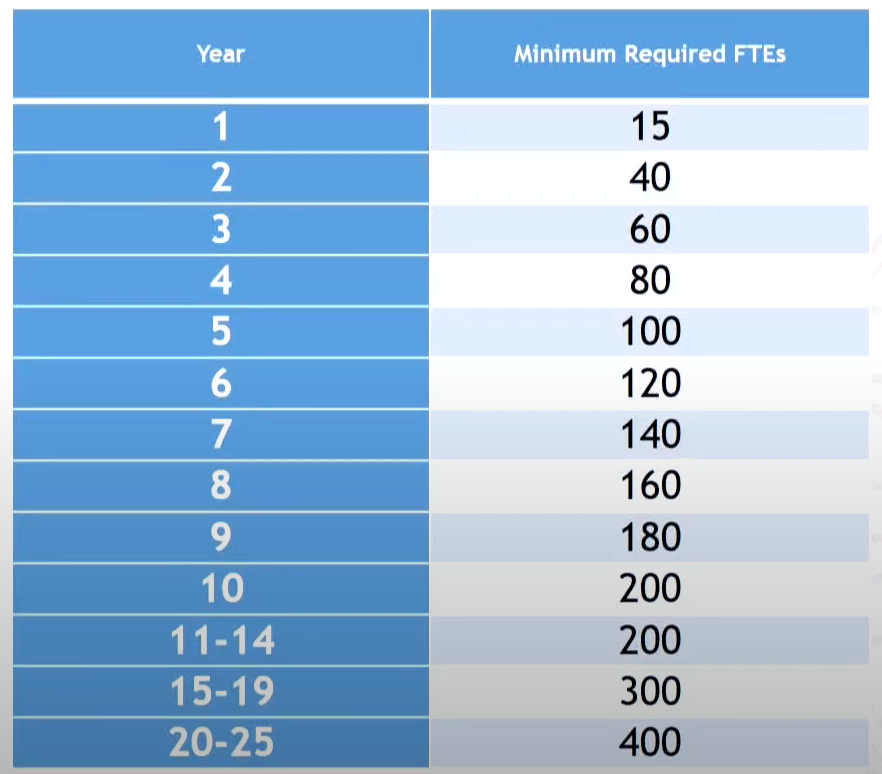

Those 400 jobs will be created over the course of 25 years, and the agreement requires a certain number of jobs to be online each year. That outline is as follows:

Financial Incentives

The City of Kerrville and its EIC will invest approximately $2.3 million in the new facility in the form of incentives, loans, and waived fees. The majority of this total (approximately $2 million) will come from 4B sales tax revenues administered by Kerrville’s Economic Development Corporation, an entity that oversees approximately $3 million in annual sales tax revenues that must be spent on economic development projects as specified in state law.

Where, exactly, does this money come from? Contrary to a popular misconception, 4B revenues are not raised through property taxes. These funds are raised through a 0.5% sales tax on taxable purchases within the city limits of Kerrville (and on other taxable sales that originate in Kerrville, such as mail-order manufacturing sales from companies like James Avery). This tax was voted into law by local residents in the 1990s and the EIC has contributed approximately $55 million in funding for various projects over the past 20 years, including recent contributions to fund the River Trail, Doyle Community Center, Arcadia Theater, Legion Lift Station, Sports Complex, and many more. The EIC’s annual revenue in recent years is approximately $3 million.

Over those past 20 years, the majority of EIC funds went toward “quality of life” economic improvements, such as the River Trail and Sports Complex. While these projects objectively improve our local economic picture, they do not necessary provide a measurable link to actual job creation. Only two recent projects can be fairly described as direct job creation funding agreements: Fox Tank and James Avery in 2012 and 2015, respectively.

In addition to local incentives, KMM will also receive approximately $1.76 million in state funding. This state funding was conditional on the local incentives. In other words, local incentives were required to secure the state funding.

Other Factors

Financial incentives from the State of Texas and local entities certainly helped entice Killdeer Mountain Manufacturing to bring this facility and these jobs to Kerrville. In addition, a number of other factors influenced the company’s decision to expand to our community.

- Quality of Life — KMM’s vice president Kristin Hedger stated during the August 18 EIC meeting that various quality of life projects such as the river trail, the Kerrville-Schreiner Park, and the abundant natural resources and recreational opportunities of the area all contributed to the decision to locate in Kerrville.

- Professional Staff — The KMM administration lavishly praised the City of Kerrville’s leadership team for their role in these negotiations.

- KEDC — Gil Ramirez and the Kerr Economic Development Corporation worked tirelessly to execute the Skymaster negotiations and were praised by KMM.

- Workforce — KMM wishes to attract and draw from a larger and more diverse workforce.

- Customer Base — KMM wishes to expand their footprint nearer to existing customers.

- Family Connections — The Hedger family has personal connections to Kerrville.

- Community Size — KMM stated that they prefer to locate in smaller communities.

- Elected Leaders — KMM noted that the City Council was especially receptive and cooperative during the negotiation process, and a spirit of cooperation and community was a huge part of the KMM decision to locate in Kerrville.

Takeaways

Landing this huge deal was a tremendous accomplishment for the negotiators, including city staff, KEDC, EIC, and other stakeholders. As numerous observers have stated, this is a once-in-a-half-century (or longer) type of deal for a city our size. While some of the benefits will take time to visualize, the potential upside for Kerrville is practically unlimited. We get good jobs, a quality employer and taxpayer, and residual benefits such as additional suppliers that may locate in Kerrville, bringing new jobs with them. Also, residual benefits that are referred to as the “multiplier effect,” adding to the local economy.

Financial incentives are always controversial when applied to private corporate interests, but they are part of the landscape of economic development, and must be viewed as an investment in the future of our city, and an investment in our workforce. And as financial incentives go, this deal is a win for the City and its taxpayers. There will be NO ad valorem or personal property tax abatements, meaning KMM will immediately start contributing to the city, county, and school district tax revenues. And the majority of the funding comes from a source that MUST be spent on economic development — by law. By providing these incentives, our community was able to leverage nearly $1.8 million in state funds to help secure this deal — a windfall for this community.

The Economic Improvement Corporation (EIC) and City Council will now hold public hearings and public votes to consider the final agreements. Watch for agendas to find out when and how the various aspects of this agreement will be debated. Public input will be welcomed during this due diligence period.